You may have seen an advertisement telling you, “We can clear your bad credit-100% guarantee”, or it may be something they promised they can do: “Legal way create a new credit identity.” A company like this is probably a scam.

Attorneys for the Federal Trade Commission and the US Consumer Protection Agency said they have never seen a legal credit repair operation to make these affirmations,” the FTC website said.

If your score drops, repairing your credit “takes time, and there is no quick way to repair your score… The best advice for rebuilding credit score is to manage it responsibly over time.”

In case you’re in a position where you’re broke, you may be thinking about instant online payday loans. Most people understand that a payday loan comes with its disadvantages. Still, if you need money now, it can feel like the only option.

To start with, it’s essential to see every one of the expected outcomes of a payday loan – like how it can hurt your credit score.

Payday loans usually work as a way to borrow from your next paycheck. Since the course of action expects you to pay the money back using your upcoming paycheck, the loan term is typically only half a month long (normally two weeks or one month).

Once you’re approved for a loan, the funds will be deposited into your account.

Most individuals who take out a payday loan have poor or little credit. Subsequently, payday moneylenders charge amazingly high APRs and take post-dated checks for repayment to balance the danger of loaning to individuals with awful credit.

Indeed, even in a crisis, payday loans are normally not the most ideal choice. The Consumer Financial Protection Bureau (CFPB) refers to payday loans as “debt traps” and urges customers to know about the danger of payday loans.

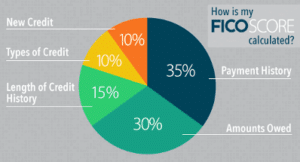

Now you have bad credit that you want to improve, before starting the repair, you need to understand the five components that affect your credit score.

- Payment history – 35% score-paying all bills on time will help you increase your score as quickly as possible.

- Percentage of your score – reducing the amount you owe will also greatly improve your score.

- The length of the credit history – 15% of your score – the longer you have an open credit history, the better.

- The new credit limit – 10% of your score every time you sign up for a new credit card or loan, your credit score may drop for at least a short period.

- Credit type used – 10% score – A good combination of credit types (credit cards, installment loans, and long-term loans such as mortgages) will further improve your score.

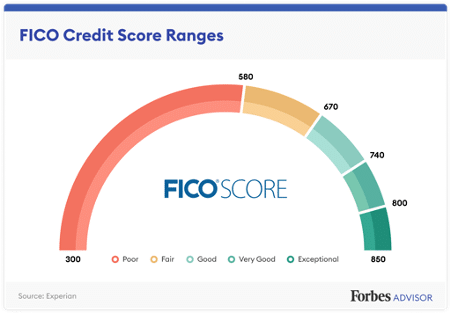

FICO, the American company which stands for Fair Isaac Corporation. The company introduced the first universal FICO score in 1989. Since then, consumers have relied on maintaining a good FICO score to obtain loans and credit cards – especially if they want low-interest rates and generous terms. It is now clear that there is no quick solution to improve anyone’s credit score.

How to Fix Your Credit Score

#1 Step: Understand How Your Credit Score Is Determined

#2 Step: Pay the Bill on Time

Since the 35% FICO score is based on your bill payment history, paying bills on time each month is the most important thing you can do with your score.

#3 Step: Obtain Your Credit Report

Now that you need to pay your creditors on time, the next step is to obtain a copy of your credit report. You will need to apply for a free report from each credit reporting agency (Equifax, Experian, and Trans-Union). Don’t sign up for a credit monitoring service, just get every report for free.

#4 Step: Correct Any Errors

Check each report carefully. If you find any errors, please correct them individually to each credit reporting agency. Generally, you are regarded as guilty until proven innocent. When writing a letter to the credit authority, be sure to send a copy (not the original) that may have evidence to avoid errors in the FICO report.

#5 Step: Monitor Your Progress

By monitoring your score, you can see how effective your credit repair is. In addition to getting free reports, there are many ways to get them for free. Many credit cards offer you a free monthly credit score.

If you have not yet registered for free points, pls check with your credit card or bank for the free service. You can also sign up for a free credit monitoring website, but make sure there are no hidden monthly charges.

Bottom Line

The right credit fix isn’t quick. It takes time and perseverance. Don’t fall into a quick repair scam. There is no legitimate method to quickly fix your credit score. Try spotting FICO repair scams and outrageous credit fixes which is why it doesn’t work.

The best strategy is to ensure that all bills are paid on time. Try not to apply for new credit unless you really have to. People usually sign up for a new credit card to get a one-time discount. You can use lower credit scores and higher interest rates to pay for multi-year discounts.