Proprietary trading is a term that relates to the type of trading in which the trader uses his or her own money to participate in the market. This differs from depositor funds where the trader uses other people’s money to participate in the market. Traders who participate in this type of trading are called market makers. Market makers are responsible for providing liquidity in the market. In addition, alternative data traders study charts and chart patterns to determine whether a particular stock is likely to go up or down.

Market makers provide liquidity

Market makers are professional traders who provide liquidity to the market. Their job is to make trading easier for both retail and institutional traders. They use trade data from across markets to set a fair price and accumulate inventory. They are also frequently involved in derivatives trading to manage risk. While market makers don’t actually know the future price of a stock, they do know the current value of a stock. These traders provide liquidity for investors by settling trades and helping them buy and sell stocks.

To be a market maker, you must have a demonstrable understanding of customer demand in the near term. Market makers can trade with one another to obtain inventory or minimize the risk of an existing position. However, the Commission will take the dealer’s willingness to trade into account when determining whether they are acting as a market maker. If you are in the process of becoming a market maker, the rule below will help you get started.

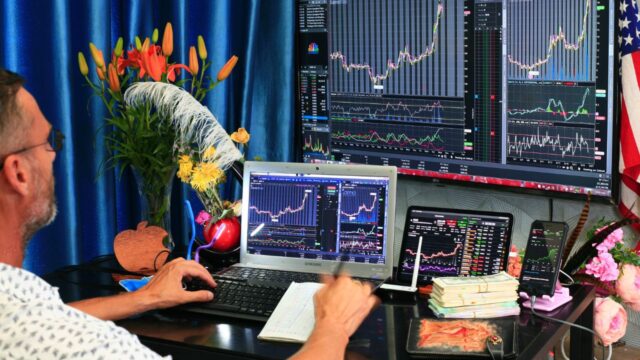

Alternative data traders analyze chart patterns

Some alternative data traders use these charts to identify potential trades. However, there are many differences between these chart patterns and general chart analysis. First of all, you should never make the mistake of thinking that all chart patterns are created equal. These patterns are not only related to trading, but also to a particular asset or security. For instance, if you want to trade gold, you must know how to read technical analysis based indicators.

Chart patterns form in the market because of traders’ knowledge-based bias. They buy and sell at crucial price levels or key support and resistance levels. As a result, these traders create price barriers in the form of channels, action/reaction lines, or geometric structures. Successful traders understand how to analyze these patterns and how they are created. The key to trading with these patterns is to know this body of knowledge. If you do not, you might end up making a mistake and losing money.

Profitable trading with a proprietary trading firm

If you are interested in day trading, you should consider working with a proprietary trading firm. A prop firm hires you and provides capital, coaching, risk management strategies, and education. Traders earn a profit split that is typically up to seventy five percent of their profits. They also receive a significant amount of money to invest. This allows them to learn the ins and outs of day trading and avoid the common mistakes made by traders.

The benefits of working with a proprietary trading firm are many. Traders have the benefit of having access to advanced software and high-level data. In addition, trading with a prop firm can help you avoid conflicts of interest and give you priority algorithms to maximize profits. The downside to working with a prop firm is that you will be forced to put in lots of time and effort in order to learn the software.

Registering with a proprietary trading firm

To register with a proprietary trading firm, the first thing you need to do is decide what type of entity you are. A company, partnership, or sole proprietor will suffice. You should also register with the securities exchange commission and your national securities association, if applicable. This will allow you to access market data and execute trade orders. Moreover, you can also register with multiple firms, as long as you have an appropriate combination of experience and credentials.

Proprietary trading is strictly regulated at large banks. While large banks had prop trading desks in the past, they are prohibited from doing so after the financial crisis. The Securities Exchange Act of 1934, which is the backbone of financial regulation in the US, contains stubborn clauses that make it difficult for smaller firms to comply with the requirements. However, the proposed exemption does not apply to small firms. The SEC’s proposal is a good first step.

Conflicts with investment banks

There have been numerous complaints about conflicts of interest involving investment banks and their analysts. Some regulators and state securities regulators have pursued criminal charges against investment banks over these issues. This article examines the conflict of interest and identifies some of the factors that may lead to conflicts. The authors find that the biggest conflict of interest lies in the way research is distributed to investors, as well as when proprietary trading information is provided to investors. In addition to these issues, there are other, more subtle conflicts that can arise between investment banks and their customers.

While the SEC has made conflict of interest a top enforcement priority in recent years, the CFTC has been somewhat less vocal. Despite recent concerns, investment banks have been found guilty of a number of violations related to conflicts of interest. For example, one study found that Citigroup failed to disclose conflicts of interest involving proprietary mutual funds and hedge funds. Further, the respondents failed to disclose whether they preferred proprietary products or not.