Have you ever heard of Elliottt wave theory? If you’re an investor or a trader who has been in the game for some time, the answer will be yes. The theories established by Ralph Nelson Elliottt have become one of the most relied-upon strategies market participants worldwide use for navigating volatile prices and making informed investment decisions. But how effective is Elliott wave theory as a forecasting tool?

In this article, we’ll explore the Elliott wave theory and examine why it’s still so popular today among investors despite its limitations.

Introducing Elliott Wave Theory – What is it and who developed it

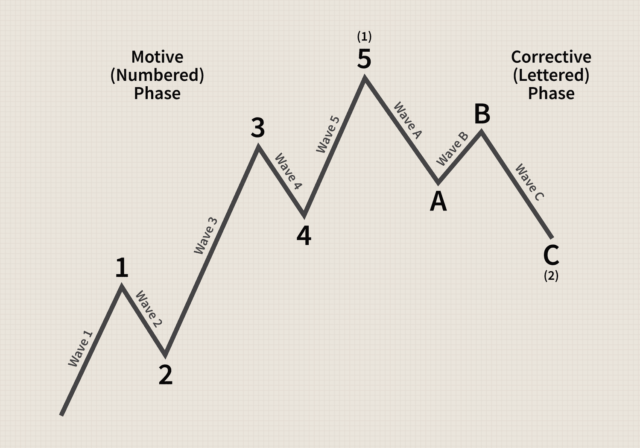

Elliott Wave Theory is a renowned technical analysis tool used in financial markets for identifying market trends and predicting future price movements. Ralph Nelson Elliott, a prominent economist and account executive, developed the concept. Elliott scrutinized the repetition and sequence patterns in market data, which eventually led him to establish his fascinating theory.

This analysis model is primarily based on the principle that price movements of any financial instrument are not random and can be classified into waves consisting of an impulsive wave and a corrective wave. Today, traders and investors worldwide use Elliott Wave Theory to identify trend reversals and trading opportunities.

Advantages of using Elliott Wave Theory in stock market trading

The main advantage of Elliott Wave Theory is its ability to identify the direction of the trend. It is a great advantage for traders and investors looking to benefit from price movements within an uptrend or downtrend. Additionally, by using Elliottt’s wave theory, traders can gain insights into potential support and resistance levels in the market. It gives them valuable information to plan their entry and exit points when trading securities like stocks.

Lastly, this analysis tool can be used in any timeframe — long-term, medium-term, or short-term — making it versatile and applicable in various markets across different asset classes, including Netherlands stocks.

Disadvantages of using the theory for trading and investing

Despite its advantages, Elliott Wave Theory also has some limitations. One of the main disadvantages is that it can be challenging to identify which wave is developing at any given time. It makes it hard to accurately forecast future price movements. Additionally, since the theory relies on identifying patterns in historical data, it cannot fully account for external factors like news events or economic releases, which could disrupt the expected price action.

Finally, although Elliottt Wave Theory has been around for decades and is still prevalent among traders and investors, it must be a perfect trading tool due to its inherent limitations.

Analyzing a real-life example to see how effective the theory is

Let’s consider an example to get a better idea of how practical Elliott Wave Theory can be in practice. Let’s assume that you’re trading Netherlands stocks and spot a potential uptrend according to the Elliottt Wave Theory guidelines. Based on the wave theory pattern, you decide to buy the stock and set your target at an anticipated resistance level. If it works out as expected, you could make a decent return from your trade.

On the other hand, if prices don’t follow the anticipated trend or something unexpected happens, like a news release or economic event which affects the stock’s price action. You must find a way to reach your target profit or break even.

Highlighting the potential benefits of incorporating this strategy into your investments

Despite its limitations, Elliott Wave Theory provides investors with valuable insights into the direction of market trends and potential trading opportunities. By studying and understanding this strategy, investors can gain a competitive edge over other market participants who must be aware of this analysis tool. Additionally, it can be used in any timeframe for short-term and long-term investments, thus giving traders ample flexibility in their trading strategies.

Finally, incorporating this strategy into your investments can help you optimize the risk-reward ratio of your trades and potentially increase the chances of achieving more significant returns. It is worth considering if you want to maximize your profits in trading or investing. Due to its inherent limitations, it’s important to remember that Elliott Wave Theory should be used with other analysis tools to ensure your decisions are based on a well-rounded and comprehensive approach.

In conclusion

Elliott Wave Theory can be a powerful tool for traders and investors looking to gain an edge against others in the market. Despite its limitations, it offers valuable insights into potential price movements, which can help you optimize your risk-reward ratio when trading securities like Netherlands stocks. It is worth considering if you want to maximize your profits in trading or investing. However, it should always be used with other analysis tools to ensure that your decisions are based on a well-rounded and comprehensive approach.