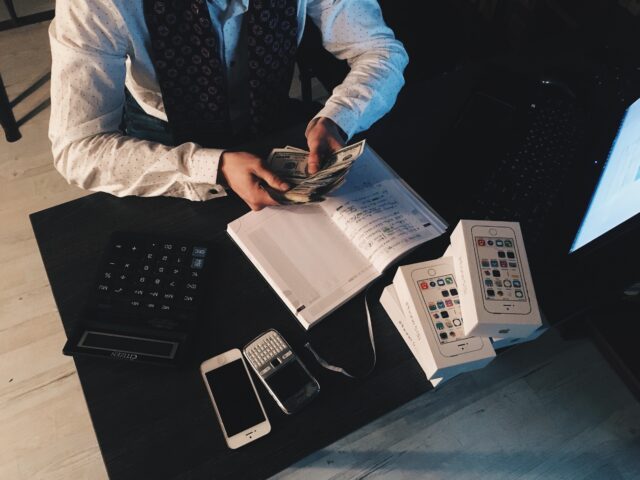

Surprisingly, the average small business owner spends more time managing their money than running their business. The reason for this is simple: most entrepreneurs struggle to understand the financial basics of operating a company. The good news is that, by knowing the right approach, you can be better informed about your finances and make smarter money management decisions for your business.

Here are 8 everyday money management tips for small business owners.

Track Your Spending

Knowing where your money is going means tracking your spending and understanding your company’s financial position. You can set up a system to track your income and expenses, record transactions in a software program, or use a simple spreadsheet. Review your spending regularly to identify any areas where you can cut costs.

Make a Budget and Stick to It

Once you know where your money is going, you can plan how you want to spend it. This is where creating a budget comes in. A budget will help you track your progress, keep costs under control, and make sure you are always aware of your financial situation. When making a budget, be realistic and honest about your spending habits.

Understand Your Tax Obligations

Ignoring taxes or not knowing them can land you in legal trouble as a business owner. So, it pays to know which taxes you need to pay and when they are due. The most common taxes for small businesses include income tax, GST/HST, payroll tax, and property tax. Make sure to stay on top of your taxes by setting up a system to track your payments and filing deadlines. Consider hiring a financial expert for the same.

Keep Your Personal and Business Finances Separate

This will help you stay organized, avoid using company funds for personal expenses and make it easier to track your spending. Open a separate checking bank account for your business and use it exclusively for business transactions.

You can also consider a credit union to hire a cab company for your employees if needed. Having a business account will help you track all these expenses easily.

Stay on Top of Your Invoices

Sending out invoices and following up with customers can be time-consuming, but it’s important to do it if you want to get paid. Use an invoice tracking system or software to help you keep track of your invoices and payments. You can also send automatic reminders to customers who haven’t paid their invoices yet.

Invest in the Right Insurance

As a business owner, you need to ensure you have the right insurance to protect your company from any potential risks like theft or property damage. The type of insurance you need will depend on the type of business.

Various business insurance types include:

- Property insurance.

- Liability insurance.

- Product liability insurance.

- Business interruption insurance.

- Key person insurance.

- Professional indemnit;’[y insurance.

Don’t forget to work with an experienced broker to find the right insurance for your business.

Keep Your Books Up to Date

Keeping accurate and up-to-date financial records will help you track your progress, understand your financial situation, and make informed decisions about your money. You can also hire a professional accountant or bookkeeper to help you with your bookkeeping. Other options include using accounting software to make the task easier.

Seek Professional Help When Needed

Considering professional help could be useful when you’re starting a business, going through a growth phase, or experiencing financial difficulties. Make sure to choose someone qualified and experienced in working with small businesses. Also, always get everything in writing to avoid any misunderstanding later on.

Final Word

Managing your business’ finances can give you sleepless nights if your approach isn’t right. We’re sure the above tips will help you gain full control of your company’s finances.